Car title loans offer quick funds but carry risks. Fort Worth regulations protect borrowers with clear requirements, capped rates, and limited collections. Consumer advocacy groups guide borrowers, negotiate terms, and expose hidden fees to avoid debt cycles and ensure fair treatment. Utilize these resources for informed decisions regarding car title loan emergency funding.

Struggling with unexpected expenses? A car title loan might seem like a quick fix, but it’s crucial to understand your rights and options first. This guide navigates the world of car title loans, empowering you with knowledge about consumer protections and reputable organizations that advocate for responsible lending practices. We’ll also help you identify the best loan options through comparisons and reviews, ensuring you make an informed decision.

- Understanding Car Title Loans: Rights and Protections

- Identifying Reputable Consumer Advocacy Organizations

- Navigating Loan Options: Comparisons and Reviews

Understanding Car Title Loans: Rights and Protections

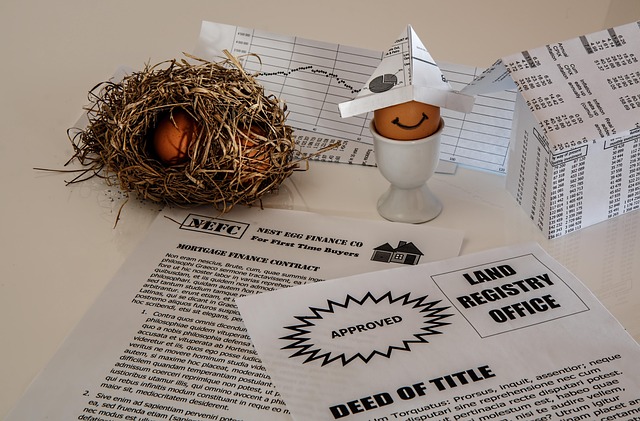

Car title loans can be a quick solution for emergency funding needs, but it’s crucial to understand your rights and protections before applying. These types of loans are secured by the vehicle’s title, meaning the lender has the right to take possession of your car if you fail to repay as agreed. However, consumers have certain safeguards in place to protect them from predatory lending practices.

In many regions, including Fort Worth Loans areas, there are strict regulations for car title loan providers. These regulations outline clear Loan Requirements and limit interest rates, fees, and collection tactics. Consumer advocacy groups play a vital role in ensuring these rules are enforced and providing support to borrowers facing issues with their lenders. Understanding your rights can help you make informed decisions when considering a car title loan as an emergency funding option.

Identifying Reputable Consumer Advocacy Organizations

When considering a car title loan, one of the most important steps is to identify reputable consumer advocacy organizations. These groups are dedicated to protecting the rights of consumers and can provide valuable guidance on navigating financial challenges. Look for well-established organizations that have a proven track record of advocating for borrowers, such as those affiliated with national or state bar associations, as they often offer legal resources and advice.

In Fort Worth Loans, for instance, there are numerous consumer advocacy groups that focus on vehicle equity loans. These organizations can help you understand your rights, explain the terms and conditions of any loan agreement, and even assist in negotiating better rates. By leveraging their expertise, you can make informed decisions and access financial assistance when needed without falling into a cycle of debt. Remember, reputable advocates will offer unbiased support, ensuring you receive fair treatment throughout the entire process.

Navigating Loan Options: Comparisons and Reviews

When exploring car title loan options, it’s crucial to approach this decision with caution and thorough research. Navigating the world of loans can be a complex task, especially when considering emergency funding or quick cash solutions like car title loans. Consumer advocacy groups play a vital role in guiding borrowers through these labyrinthine processes. They provide comprehensive comparisons and reviews of various loan providers, highlighting key aspects such as interest rates, repayment terms, and customer service quality.

These advocates ensure that consumers make informed choices by shedding light on the often subtle differences between lenders. For instance, when seeking emergency funding or quick funding options, borrowers might find flexible payment plans appealing. However, a detailed review can reveal hidden fees or less-than-ideal terms within seemingly attractive offers. Therefore, relying on consumer advocacy resources is essential to avoid pitfalls and secure the best possible loan conditions that align with individual needs.

When considering a car title loan, it’s crucial to first understand your rights and explore reputable consumer advocacy organizations for guidance. These resources empower you to make informed decisions by comparing loan options and reading reviews. By navigating these steps, you can ensure a safer and more transparent process when seeking financial assistance through a car title loan. Remember, with the right information, you’re better equipped to protect yourself and find the best solution for your needs.